您现在的位置是:Fxscam News > Exchange Brokers

Bitcoin heads toward $70,000, fueled by global monetary easing.

Fxscam News2025-07-22 03:26:19【Exchange Brokers】9人已围观

简介Foreign exchange gold 50 survey,Foreign exchange payment process,Boosted by global loose monetary policies, Bitcoin is experiencing a new wave of growth. A recent re

Boosted by global loose monetary policies,Foreign exchange gold 50 survey Bitcoin is experiencing a new wave of growth. A recent report from 10X Research predicts that, influenced by the Federal Reserve's rate cuts and China's large-scale quantitative easing policies, Bitcoin prices are likely to break through $70,000 and set new highs by the end of October.

Over the past month, the price of Bitcoin (BTC) has increased by more than 10% and is now stable above $65,000, up over 30% from the previous local low of $49,000. This strong momentum has significantly boosted market confidence, with analysts optimistic about its long-term development prospects.

Bitcoin's current market price is higher than the average realized value over the past year, indicating growing confidence among long-term investors and suggesting a more permanent uptrend.

The latest report from 10X Research further analyzes Bitcoin's market outlook. The report indicates that Bitcoin has successfully reversed its previous downward trend and is moving towards the $70,000 mark, with expectations to surpass this level within two weeks. As the end of October approaches, the market anticipates Bitcoin will reach new historical highs.

In addition to the Federal Reserve's rate cut cycle, 10X Research also emphasizes that China's loose policies will increase global liquidity, leading to a parabolic price rise in the cryptocurrency market. Previously, Bitcoin had once surged above $73,000 following events like the halving event, Trump's support, and the listing of Bitcoin ETFs. This time, it may be gearing up for another wave of growth.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(82)

相关文章

- Who can actually "buy" TikTok, valued at $200 billion?

- How to Choose Forex: The Differences and Advantages between Overseas Forex and Domestic Forex

- Forex Trading Basics: A Beginner's Guide

- FxPro Review: The Canadian Dollar Is Poised to End the Week Higher After a Prolonged Decline

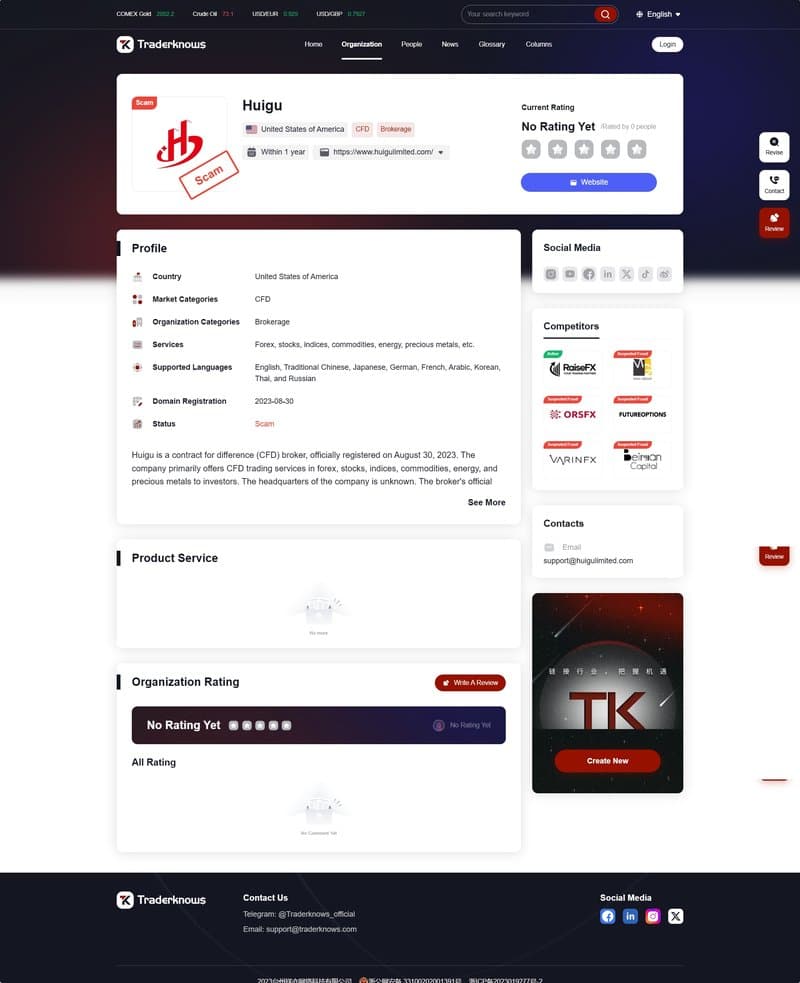

- QCG Brokers Review: High Risk (Suspected Fraud)

- FxPro Market Commentary: US Dollar to Japanese Yen: Samurai Weighing Their Next Move

- Criminal Prosecution: FCA Initiates Legal Action against "Kube Trading" Operator

- FxPro Market Review: Oil Prices on the Verge of a Breakthrough, Testing Key Support Levels

- Market Insights: April 9th, 2024

- FxPro: Daily Technical Analysis before the European Market Opens on March 26, 2024

热门文章

- TradeWill Trading Platform Review: High Risk (Suspected Fraud)

- Geopolitical tensions and supply concerns drove WTI crude oil prices to reach the $80.90 mark.

- The strong dollar sweeps through, leaving emerging market currencies no match!

- FxPro Market Review: Oil Prices on the Verge of a Breakthrough, Testing Key Support Levels

站长推荐

Madden Markets Limited Review: High Risk (Suspected Scam)

FxPro: Daily Technical Analysis Before the European Market Opens, March 19, 2024

FxPro: Yen rises on hopes for Bank of Japan policy shift.

Significant Decline in Multiple National Currencies Against the US Dollar

One Global Market broker review: regulated

FxPro Market Review: It's Time for the Dollar to Choose a Trend

GBP/USD Intraday: The trend is upwards.

September 15 market analysis: China's August data is a big breakthrough.